No more stress over complex taxes and late reports, CMT Consulting’s accounting and taxation package takes the pressure off—your Vietnam tax services are handled in just 30 days after establishment and throughout the operation. We deal with tax authorities for you, guide you from setup to ongoing management, and save you time and costs while keeping your business steady!

Mục lục

Accounting & Tax After Setup—Start with Confidence

Tax compliance is a must for transparent, legal financial reporting in Vietnam. CMT’s accounting services in Vietnam for foreign businesses manage your books, file taxes accurately and on time, and set a strong financial base for long-term growth.

4 Steps to Seamless Accounting

| Steps | Do It Yourself | Use CMT’s Service |

| Get Digital Signature (Token) | Register a digital signature for e-tax filing and reporting | Provide basic information for CMT |

| Declare Initial Taxes | File initial taxes – Business license tax, VAT, and set up books post-setup Buy e-invoices – Register with tax authorities for e-invoice issuance Pay business license tax – 2-3 million VND/year based on capital Open a bank account – For company transactions and tax payments | CMT files everything, updates (if you want), and delivers results! |

| Set Up Accounting Books | Record transactions, invoices, prep monthly financial reports | Get your books handed over |

| File Periodic Reports | File VAT, TNCN (monthly/quarterly), TNDN, and annual financial reports | CMT submits and delivers your reports |

| Processing Time | 40-50 working days (with 1 revision) | 30 working days (fast approval) |

2025 All-In-One Accounting Service Pricing at CMT

Starting at 2,500,000 VND (~USD 100), our tax service package includes:

- State fees

- Notarization & translation costs

- Free document prep & processing

| Service | Deatails |

| Digital Signature (Token) | Get your digital signature right after setup |

| Initial Accounting | File business license tax, VAT, and set up books post-setup. |

| Ongoing Tax Management | File VAT, TNDN, TNCN on time via e-system |

| Financial Statement | Quarterly and annual reports (5/year) |

| Work with Tax Authority | We deal with tax authorities for you |

| Labor & Social Insurance | Declare social insurance, health insurance, and unemployment for staff |

| Ongoing Advice | Multilingual support (English, Vietnamese, Korean) on taxes, insurance, and accounting |

| Investment Monitoring Reports | For FDI projects: initial reports, periodic monitoring (6 months, yearly) during setup and operations. |

FREE Document Check and Detailed Consultation

CMT Commits to:

- 24/7 Support via hotline/email—replies within 2 hours.

- No hidden fees, no matter the challenge.

- Multilingual help: English, Vietnamese, Korean.

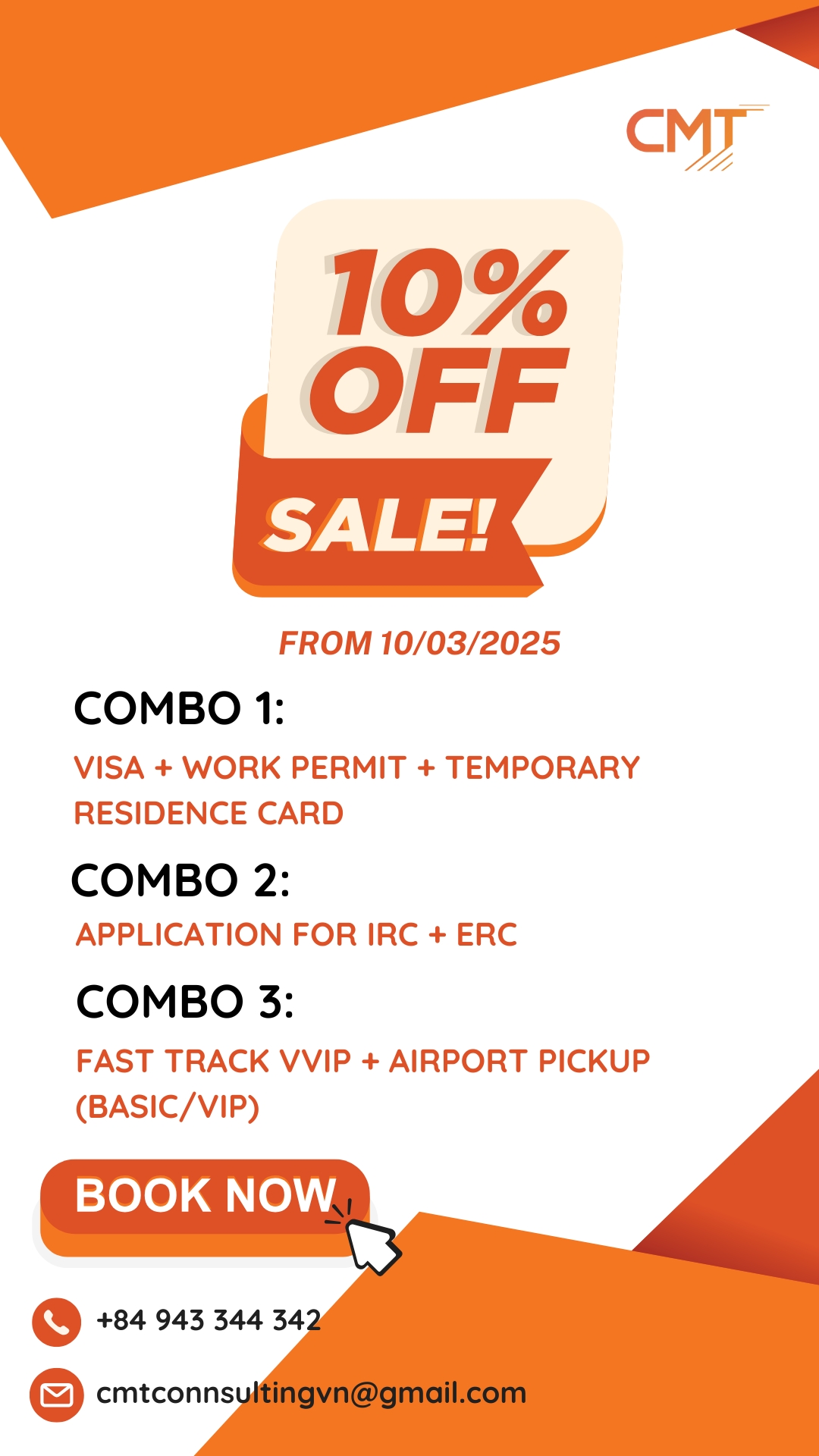

Special Offer—Grow Easy with CMT!

- 10% OFF: Full initial and ongoing accounting services in Vietnam.

- 15% OFF: Combo of Company Setup + Full Accounting + Audit.

- Free 12-Month Legal Advice: We’ve got you covered!

FAQs about Accounting & Tax in Vietnam

What Invoices Do FDI Businesses Need to Declare?

Input Invoices (Purchases):

- Materials, goods

- Services (electricity, water, internet, rent)

- Fixed assets

- Advertising, marketing, training

- Transport, logistics

Input Invoices (Purchases):

- Materials, goods

- Services (electricity, water, internet, rent)

- Fixed assets

- Advertising, marketing, training

- Transport, logistics

Filing Deadlines:

- VAT: Monthly or quarterly (based on business size).

- Due: By the 20th of the next month (monthly) or 30th of the first month of the next quarter (quarterly).

CMT ensures accurate filings—no 10-20% penalties for unreported taxes!

What Revenue Is Taxable?

VAT (Law 13/2008/QH12):

- Sales of goods/services in Vietnam (including to foreigners)

- Asset leasing

- Real estate transfers

Corporate Income Tax (Law 14/2008/QH12):

- All production/business revenue

- Capital/real estate transfers

- Intellectual property rights (copyrights, trademarks)

- Project transfers

- Asset leasing

- Other income (bank interest, contract penalties)

Non-VAT Taxable (Still Subject to CIT):

- Tech transfers, IP transfers

- Some financial, banking services

- Healthcare, education

- Life insurance

- Unprocessed agricultural products

Note: Missing or incorrect filings can lead to 10-20% fines on underreported taxes, plus 0.03%/day late fees.

CMT’s Vietnam tax services ensure full, accurate filings and legal tax optimization!

What Can Be Deducted from Taxes?

VAT Deductions (Law 13/2008/QH12):

Input VAT on goods/services used for taxable activities:

- Must have valid VAT invoices.

- Non-cash payment proof for purchases over 20 million VND.

Input VAT on fixed assets:

- Deductible if used for taxable activities; prorated if mixed use.

- Requires VAT invoices and non-cash payment proof (over 20 million VND).

CIT Deductions (Law 14/2008/QH12):

Business-related expenses

- Salaries, wages, employee benefits

- Materials, fuel, energy, goods

- Fixed asset depreciation

- Outsourced services (electricity, water, phone, insurance)

- Office/warehouse rent

Losses (per Article 9, CIT Law)

- Transferable fully for up to 5 years

For FDI businesses:

- Losses before tax exemptions can be transferred.

- FX gains/losses from revaluing foreign currency debts at year-end.

Deadline: File within 90 days after the fiscal year ends.

Keep all invoices and docs ready! CMT’s accounting and taxation package maximizes your deductions—legally and efficiently!

Key Notes After Accounting & Tax Setup

Fines for Late Reports

Late tax filings can cost 1-10 million VND (Decree 125/2020). CMT reminds you 15 days early—100% on time, guaranteed!

Report after Lossing E-Invoices

Lost an e-invoice? Report to tax authorities within 5-7 days. CMT handles it fast—no 5-10 million VND fines.

Address Changes Announcement

Notify tax authorities within 10 days of moving (1-2 million VND fine if late). CMT offers a 10% discount on ERC updates + tax notifications!

- Same District: File address change (ERC change) with the Business Registration Agency—no tax office steps.

- Different District: Settle taxes at the old district’s tax office, then update your address on ERC. Takes 10-15 days.

Miss it, and you risk invoice suspension or tax ID deactivation. CMT ensures no disruptions with our discounted combo!

Annual Reporting

Submit financial reports by March 31 yearly (Accounting Law 88/2015). CMT files accurately and on time—keeping your business steady!

Start Stress-Free Today!

Don’t let taxes and books hold you back! With CMT’s accounting services in Vietnam, you’ll love seeing perfect reports, on-time tax compliance, and up to 70% cost savings. Let us bring peace of mind and success to your FDI business in Vietnam!

- Hotline: 094 344 342 (24/7 Support)

- Email: cmtconsultingvn@gmail.com

- Website: www.cmtconsulting.vn