No more struggling when handling change ERC in Vietnam or change IRC in Vietnam on their own—especially with Vietnam’s 2025 administrative reforms adding extra twists. With CMT Consulting’s streamlined Investment Certificate (IRC) & Business Registration (ERC) adjustment service in Vietnam, you’ll breeze through updates to your business and investment details in just 15 days. Focus on growing strong—we’ve got the paperwork covered!

Mục lục

Change ERC and IRC—Build a Stable Business Future

Updating your Enterprise Registration Certificate (ERC) and adjusting the Investment Registration Certificate (IRC) in Vietnam are legal must-dos when your company—whether 100% Vietnamese-owned or foreign-invested—needs to change its name, address, legal representative, capital, shareholders, or business lines.

CMT Consulting’s IRC and ERC adjustment services ensure that your business updates are completed quickly and in full compliance with Vietnamese regulations, allowing you to focus on growth with confidence.

3 Quick Steps to Register Changes in IRC & ERC

| Do It Yourself | Use CMT’s Service | |

| Preliminary Research | – Check if you need to change ERC in Vietnam, change IRC in Vietnam, or both. Tip: Dig into laws on the National Foreign Investment Portal (fdi.gov.vn) or ask the Business Registration Office for exact requirements | – Get advice tailored to your case |

| Prepare Documents | Draft your ERC/IRC change application: – Request form for business/investment updates – Current ERC/IRC certificates – Power of Attorney – Extra papers (case-specific) Tip: – Grab the latest templates from fdi.gov.vn or the Department of Planning and Investment – Double-check consular legalization and notarized Vietnamese translations | – Provide basic information for CMT |

| Bước 3: Submit, Tracking & Receive Result | – File at the competent agency: Business Registration Office (ERC) Investment Registration Agency (IRC) – Track online and add docs if asked – Receive your updated certificates Tip: – Check progress weekly via your online account – Show up on time to avoid lost new certificates | – CMT submits, tracks, and delivers your updated certificate to you |

| Processing Time | ERC: 10-15 working days IRC: 20-25 working days | ERC: 3-5 working days IRC: 7-10 working days |

| First-Time Success Rate | Up to 60% (with CMT’s step-by-step guide) | 98% (guaranteed with CMT’s expertise) |

With CMT’s all-in-one Investment Registration Certificate (IRC) & Business Registration Certificate (ERC) adjustment service in Vietnam, we craft the smartest roadmap to register changes in business registration information—saving you time and money. Call us at 094 344 342 for quick support!

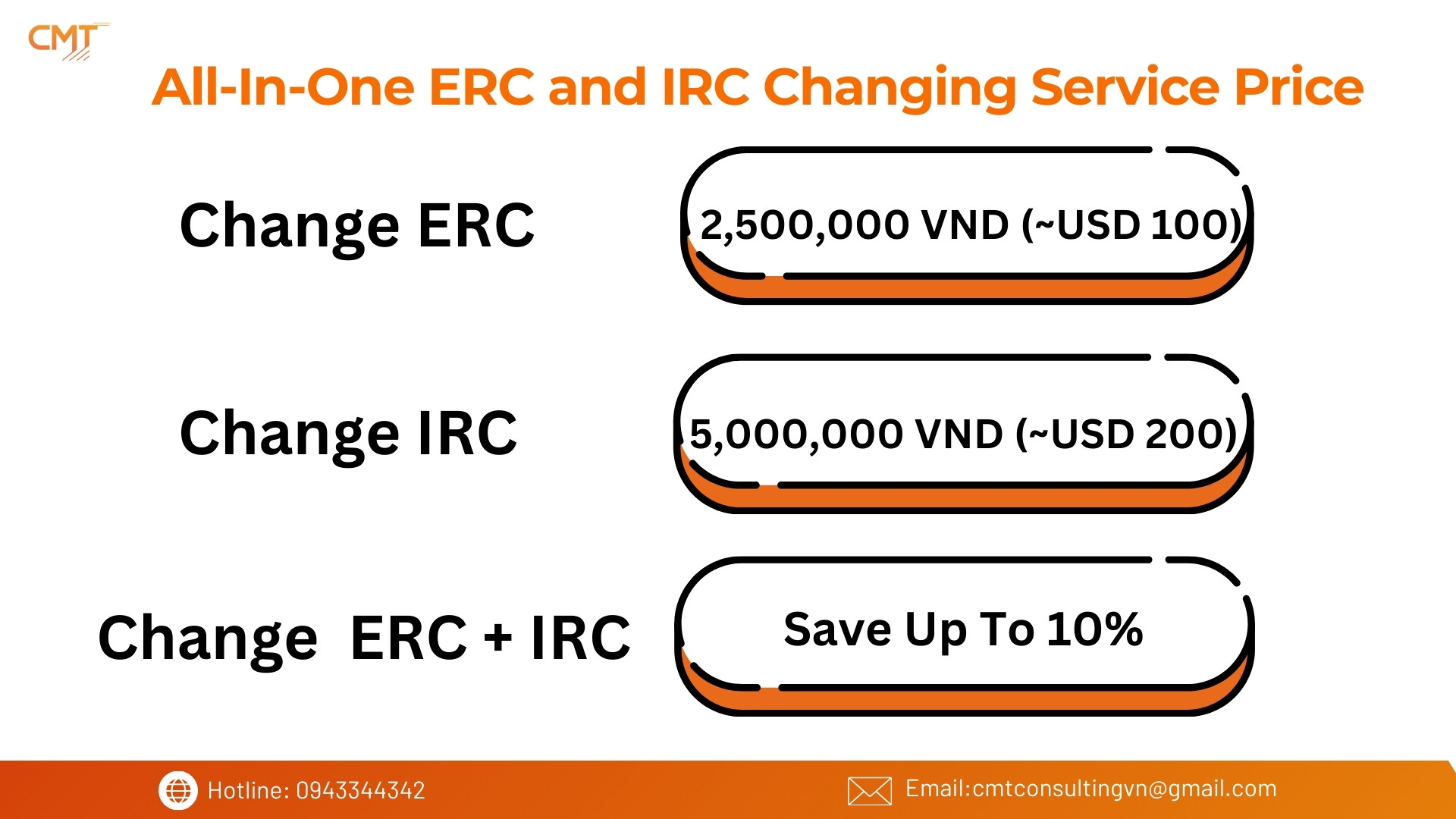

2025 All-In-One ERC and IRC Adjustment Service Pricing

- Change ERC in Vietnam: Starting at 2,500,000 VND (~USD 100)

- Change IRC in Vietnam: Starting at 5,000,000 VND (~USD 200)

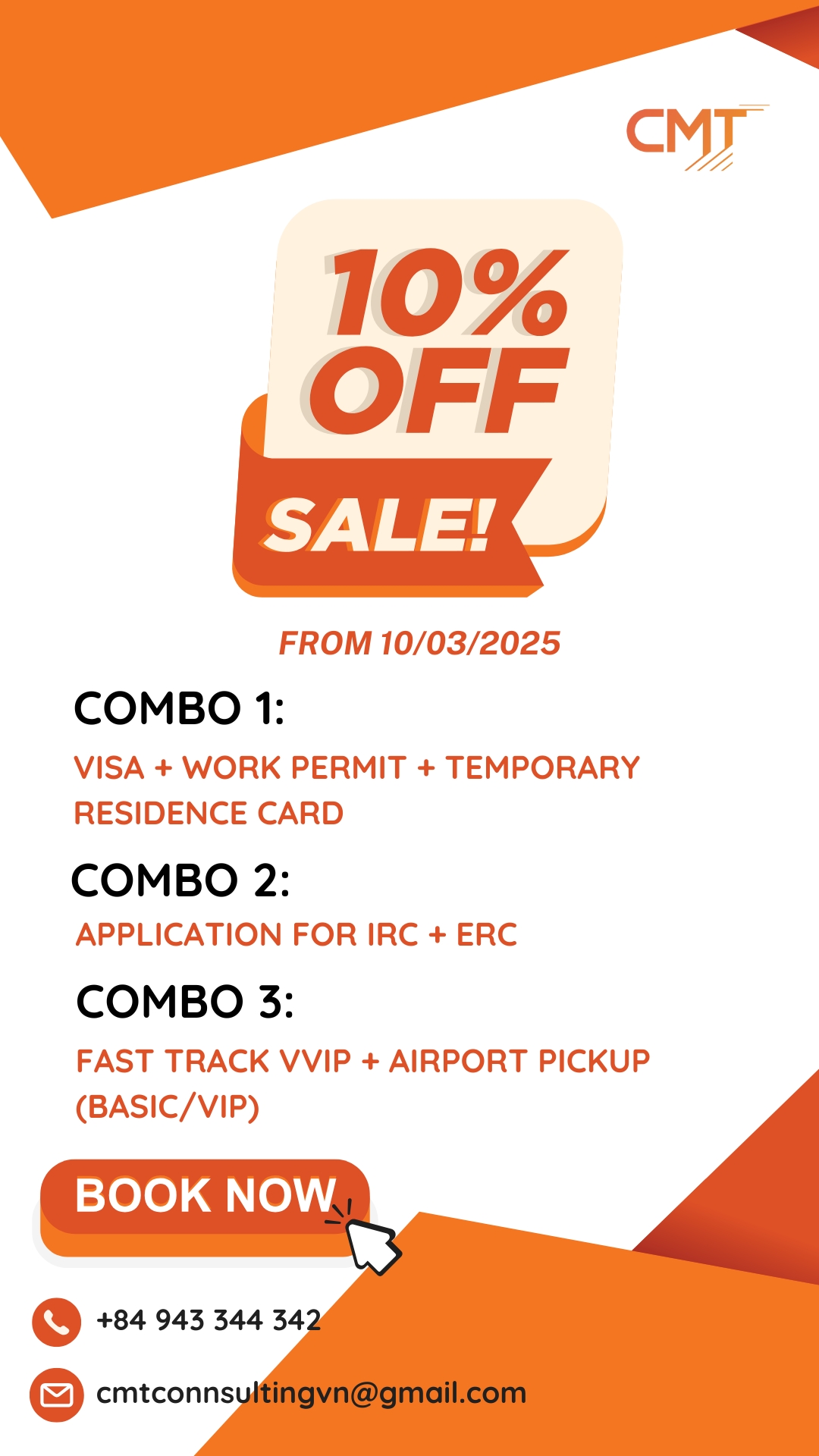

Special Offers – ONLY for NEW Clients

- 10% OFF: Full-package Changing IRC and ERC services.

- Free 3-Month Legal Advice: Expert guidance at no cost.

- 1 Month Free Accounting Service: Included with the full package.

- Bonus Sub-License Registration: Extra permit support for full-package clients

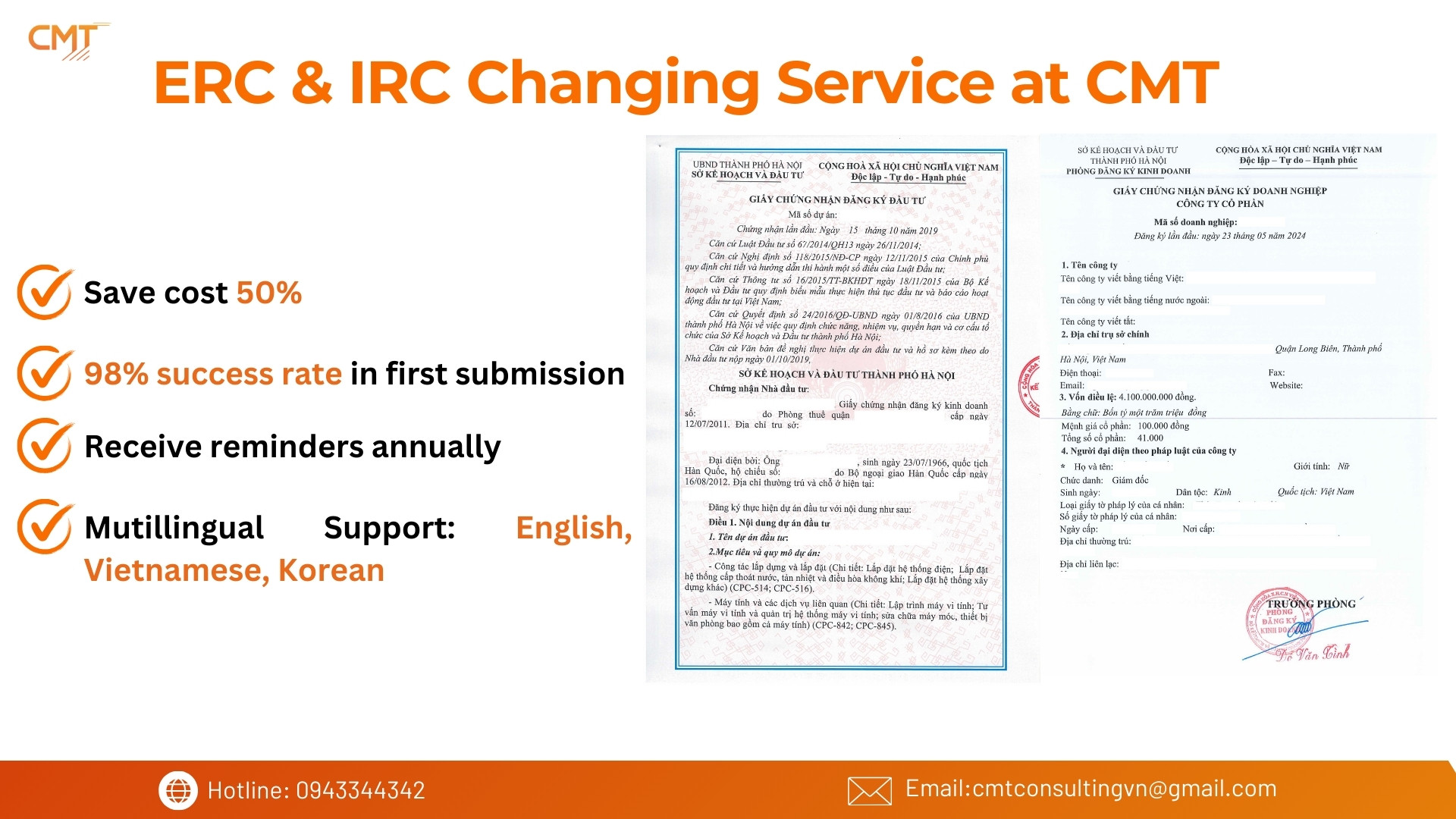

CMT Consulting Commits to:

- Fast Track: Done in 3-15 days.

- 98% Success Rate: First-time approval guaranteed.

- 100% Refund: Full money back if we can’t update your permits (excluding state fees).

- Total Privacy: Your business info stays secure.

- 24/7 Support: We’re here whenever you need us.

- No Hidden Fees: What we quote is what you pay.

FREE Document Check and Detailed Consultation

Exclusive Benefits for CMT Clients

Full Legal Roadmap

Beyond just changing ERC & IRC, we craft long-term legal plans to match your business goals.

Urgent Fixes

If your application gets trouble, CMT steps in fast with backup solutions.

Free Renewal Reminders

Never miss a deadline—we’ll keep you on track at no cost.

Bonus Legal Advice

Free consultations on sub-licenses, tax reports, financial statements, and more.

FAQs About Changing IRC and ERC

When Do You Need to Change ERC and Adjust IRC?

FDI companies and 100% Vietnamese-owned businesses must register changes in business registration information and adjust the investment registration certificate in Vietnam for updates like:

| Change Content | Change ERC | Change IRC |

|---|---|---|

| Company/Project Name | ✓ | ✓ |

| Address | ✓ | ✓ |

| Legal Representative | ✓ | ✓ |

| Capital | ✓ | ✓ (if scale changes) |

| Members/Shareholders | ✓ | ✓ (if investors change) |

| Business Lines | ✓ | ✓ (if investment goals change) |

| Project Timeline | ✓ | |

| Project Technology | ✓ |

What Documents Are Needed to Change ERC?

Basic change ERC in Vietnam paperwork includes:

- Current Business Registration Certificate (copy)

- ID/Passport of the legal representative (copy)

- Request form for business registration updates

- Company resolution/decision on the changes

Case-specific extras:

- Change to New Address: Lease contract or land use certificate

- Change to New Representative: ID/Passport of the new person (copy)

- Capital Change: Proof of capital contribution

- Business Lines: Conditional business permits (if applicable)

What Documents Are Needed to Adjust IRC?

Basic change IRC in Vietnam paperwork includes:

- Current Investment Registration Certificate (copy)

- Request to adjust the investment registration certificate in Vietnam

- Report on project progress

- Investor’s decision to adjust the project

Case-specific extras:

- Change to New Investors: Legal documents of the new investor

- Goal/Scale Change: Detailed explanation of new goals/scale

- Address Change: Lease contract/land use rights, environmental impact report (if required), site layout plan

- Capital Change: Proof of contributions, financial capacity documents

- Timeline Change: Progress report, delay explanation, tax compliance confirmation

- Technology Change: New tech details, tech transfer contract (if applicable), tech registration certificate

What Happens If You Don’t Update ERC and IRC On Time?

Failing to update your ERC or IRC on time can result in severe penalties:

For ERC:

- 3-30 million VND if overdue by 10 days

- Suspension of operations (1-3 months) in severe cases.

For IRC:

- 70-100 million VND; project suspension or IRC revocation for major violations.

Other risks:

- Blocked bank transactions

- Ineligibility for tenders or state contracts

- Damaged reputation and partnerships

Need help? Call CMT at +84 943 344 342 or email cmtconsultingvn@gmail.com for a tailored plan!

When Do You Need to Renew ERC and IRC?

ERC: No expiration—update only when details change.

IRC: Renew if:

- Project nears its end date

- Timeline lags behind commitments

- Goals need more time

Submit renewals at least 30 days before expiration—late filings get tricky. CMT makes it smooth!

Let CMT Bring Peace of Mind and Steady Growth to Your Business in Vietnam

- Hotline: 094 344 342 (24/7 Support)

- Website: www.cmtconsulting.vn

- Email: cmtconsultingvn@gmail.com