Scared to struggle and face delays when tackling the Vietnam investment process alone – especially with Vietnam’s 2025 administrative reforms? With CMT Consulting’s Investment registration certificate application service, you’ll confidently seize business opportunities in Vietnam, free from legal worries!

Mục lục

- 1 Investment Registration Certificate in Vietnam – Build Your Business with Confidence

- 2 Tips to Get Investment Registration Certificate At First Time

- 3

- 4 Cost of Full-Service Investment Registration Certificate in 2025

- 5 Special Benefits Just for CMT Clients

- 6 FAQs about Investment Registration Certificate in Vietnam

- 7 Notes After Successfully Obtaining IRC

Investment Registration Certificate in Vietnam – Build Your Business with Confidence

The Investment Registration Certificate in Vietnam (IRC) is a must-have legal document for foreign investors starting a company in Vietnam. Valid for 50-70 years, it’s your first step to legally launch and run your business.

CMT’s Investment registration certificate application service ensures fast approval and full compliance – perfect for individuals or organizations with foreign capital looking to secure their rights in Vietnam!

Tips to Get Investment Registration Certificate At First Time

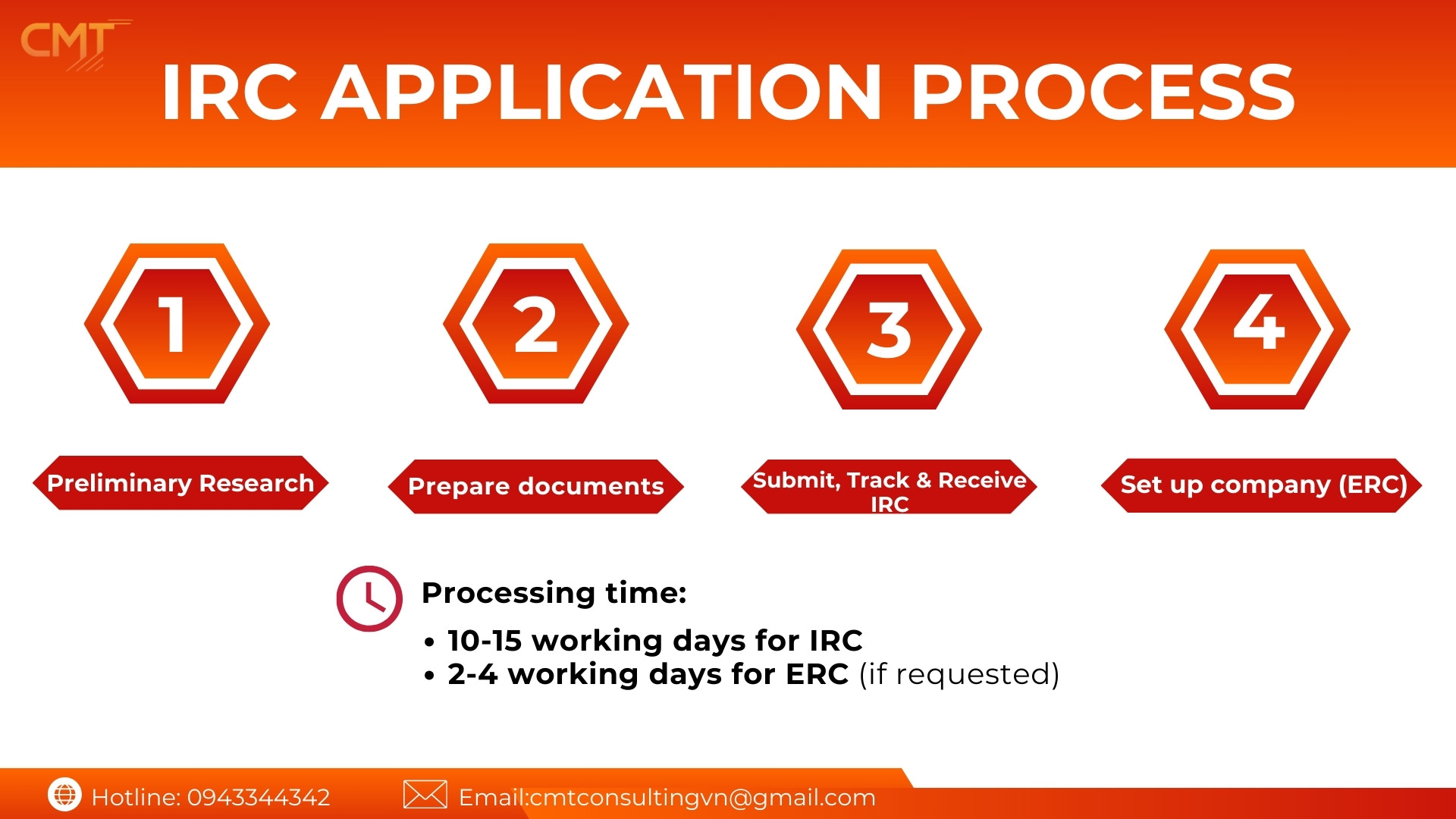

You can handle the Vietnam investment process yourself step-by-step or trust CMT’s service. Check out our table below – CMT breaks down the Investment Registration Certificate application service with pro tips to master legal requirements and boost your chances of fast, first-time approval.

| Steps | Tự làm | Đặt dịch vụ tại CMT |

| 1. Preliminary Research | – Check if you need an IRC – Confirm you meet the conditions Tip: Review Article 6 (banned business lines) and Article 9 (market access conditions) of the Investment Law 2020; look up WTO commitments to spot restricted sectors | – Get personalized advice tailored to your case |

| 2. Prepare documents | – Write your investment project proposal – Gather investor info – Plan finances and timeline Tip: – Use guides from the National Foreign Investment Portal (fdi.gov.vn) or DPI samples to avoid mistakes – Double-check documents needing consular legalization and Vietnamese notarized translation. | – Share basic details – CMT handles A-Z |

| 3. Submit, Track & Receive IRC | – File online via the National Portal, then submit hard copies to the Department of Planning and Investment – Track progress on the submission website (add documents if asked) – Pick up your IRC in person Tip: – Check progress weekly online – Collect your certificate on time to avoid losing it | CMT submits, tracks (if you want), and delivers your IRC |

| 4. Apply for Enterprise Registration Certificate (ERC) | – Submit company registration documents – Get your company code Tip: – Choose VSIC industries matching CPC codes on your IRC (see Decision 27/2018/QĐ-TTg for Vietnam’s economic sectors)- Ensure ERC and IRC details align. | CMT submits, tracks (if you want), and delivers your ERC |

| Processing Time | 20-25 working days – Longer if you need to fix documents | 10-15 working days – Approved fast and flawlessly! |

| First-Try Success Rate | Up to 60% – Much higher with CMT’s detailed tips, but still a gamble! | 98% – CMT’s guarantees success on the first try! |

Cost of Full-Service Investment Registration Certificate in 2025

Starting at just 29,000,000 VND (~1,200 USD), CMT Consulting’s full-service Investment registration certificate application service saves you money and eliminates risks – peace of mind guaranteed.

| Service Package | Basic | VIP*(Customizable) |

|---|---|---|

| Investment Strategy Advice | ✓ | ✓ |

| Investment Registration Certificate (IRC) Application | ✓ | ✓ |

| Enterprise Registration Certificate (ERC) Application | ✓ | ✓ |

| Investment Capital Account | ✓ | |

| Digital Signature (Token) | ✓ | |

| Electronic Invoices | ✓ | |

| Company Seals & Signage | ✓ | |

| Price | From 29.000.000 VND~1200 USD | From 35.000.000 VND~1400 USD |

*Note: Costs may vary based on company location, investment lines, total capital, project scale, and investor qualifications.

FREE Document Check and Detailed Consultation

CMT Consulting commits to:

- Done in 10-15 Days – 50% faster than doing it yourself!

- 98% Success First Time – Your Vietnam IRC is almost a sure thing!

- 100% Refund – If we don’t get your IRC, you get all your money back (minus government fees).

- Total Privacy – Your investor info stays completely safe with us.

- 24/7 Support – We’re here anytime during the Vietnam investment process!

- No Extra Costs – Pay what we agree – no surprises!

Special Benefits Just for CMT Clients

Full Investment Strategy Advice

- We guide you with expert tips for your Vietnam investment process.

Free Market Research

- Get a fresh report analyzing your investment industry – no cost!

One-Stop-Shop Service

No need to juggle multiple providers – CMT’s Investment registration certificate application service covers it all:

- Applying for your Investment Registration Certificate in Vietnam.

- Setting up your company.

- Opening an investment capital account.

- Finding an office location in Hanoi.

- Accounting and tax compliance services.

Free Legal Support After Approval

After your certificate, CMT stays by your side:

- Unlimited legal advice for 12 months.

- Help with regular compliance reports.

- Auto-reminders for legal duties.

- Assistance with industry-specific sub-licenses.

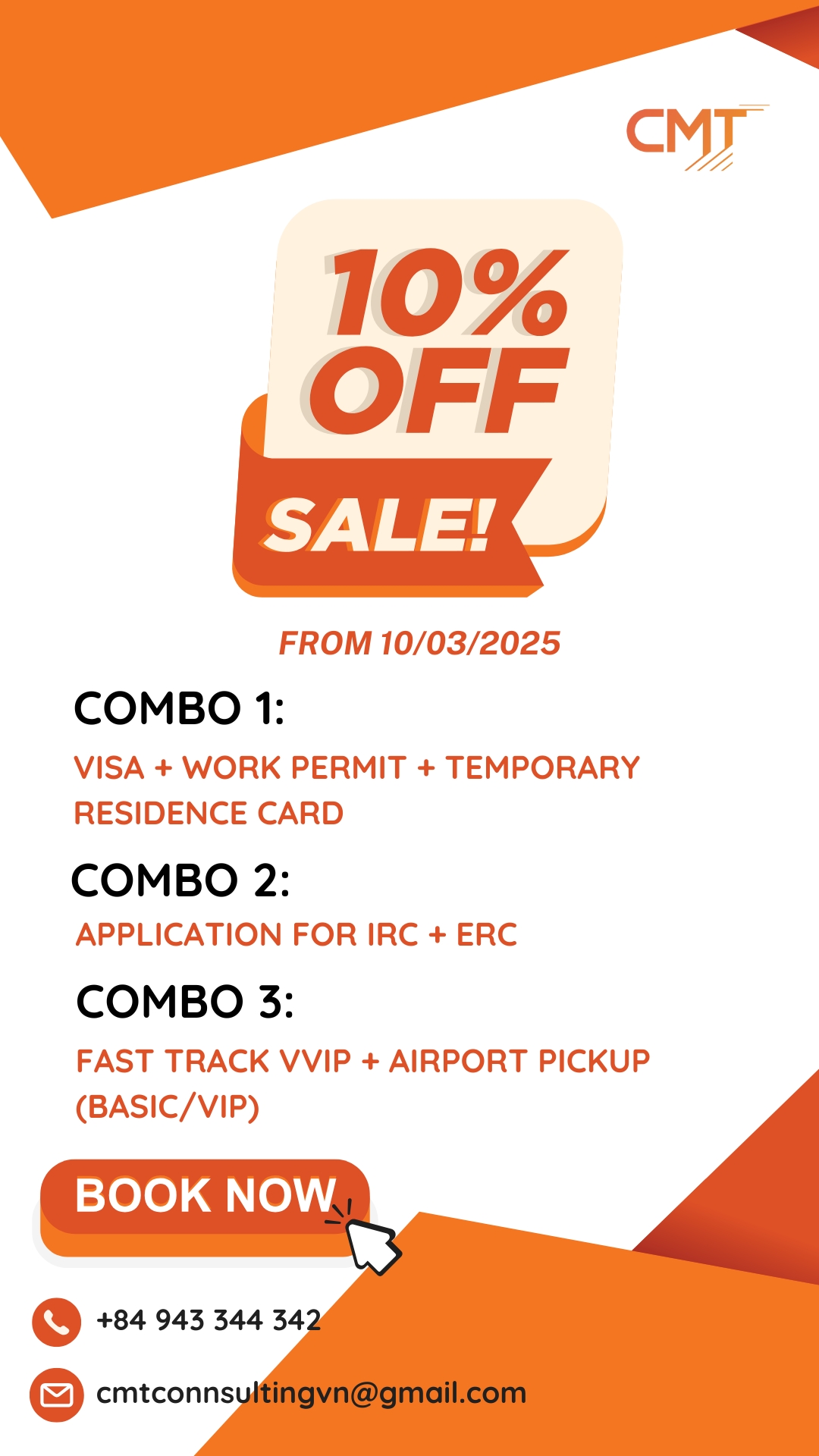

Special Offers for New Investors

- 10% Off Full-Service Fees – Save big on your Vietnam investment process!

- 3 Months Free Accounting – VIP package bonus to kickstart your books!

- Office Search in Hanoi – Exclusive for VIP package clients!

FAQs about Investment Registration Certificate in Vietnam

1. Who Needs an Investment Registration Certificate?

Based on the Investment Law 2020, foreign investors or businesses with foreign capital need an Investment Registration Certificate in Vietnam if:

- Starting a new company in Vietnam.

- Investing or buying shares with over 50% foreign ownership.

- Entering special conditional industries.

CMT checks if you need one and combines it with company setup for a fast start!

2. What Conditions Are Required?

Per Article 38 of the Investment Law 2020, you’ll get your Investment Registration Certificate in Vietnam if:

- Your project isn’t in a banned industry line.

- You have a specific project location.

- Your project fits Vietnam’s planning rules.

- You meet land-use and labor requirements (if applicable).

- You satisfy foreign investor market access conditions.

CMT ensures you meet all these!

3. What Documents Do You Need?

| Document | Note |

| Investment Project Request | Use Form A.I.1 from Circular 03/2021/TT-BKHĐT |

| Investor’s Legal Documents | Copies – if foreign, must be consular legalized and translated to Vietnamese |

| Investment Project Proposal | Detailed plan for your project |

| Financial Capacity Proof | Last 2 years’ financial reports, funding commitments, bank statements, or capacity explanation |

| Land Use Needs (if applicable) | Lease contract copy or proof of land rights. |

| Technology Explanation (if applicable) | Required for restricted tech projects (Appendix III, Decree 31/2021) |

| BCC Contract (if applicable) | For business cooperation contract investments |

| Power of Attorney (if applicable) | If someone else submits for you |

4. What’s New for 2025 IRC Applications?

Vietnam’s 2025 reforms have some changes in the Vietnam investment process, making it tricky – that’s why 78% of successful investors pick pro services like CMT from the start!

| Aspect | Old Regulation | 2025 Regulation | Investor Challenges |

|---|---|---|---|

| Approving Authority | Industrial Zone Board or Department of Planning & Invesment | New one-stop agency | New agency locationsOutdated contact infoLonger waitsLost files |

| Processing Time | 15 working days | Unspecified – 20-25 days in reality | Unpredictable delays, business plan disruptions |

| Forms & Documents | Old forms invalid, new ones not widely shared | Sudden extra requirements, multiple resubmissions | |

| Submission Method | Mostly in-person | 100% online | System glitches, complex interface, peak-time crashes, no quick tech help |

| Approval Process | Simple, few steps | Simpler prep but complex processing | Multi-agency involvement, hard-to-track progress |

5. Can Investors Set Up a Company Through Capital Contribution? Is an Investment Registration Certificate Required?

Yes, investors can smartly set up a company through capital contribution. Here’s how:

- Step 1: Set up a company with 100% Vietnamese capital.

- Step 2: Transfer capital from Vietnamese shareholders/members to foreign investors.

| Task Details | Time |

|---|---|

| Prepare Documents for Enterprise Registration Certificate Application – Advise on the best company type – Draft and file documents for a 100% Vietnamese-owned company – Guide on foreign ownership ratios | 3-5 days |

| Draft Capital Transfer Document Prepare documents for foreign capital contribution, share purchase, or stake acquisition: – Contribution request form – Agreement on contribution/shares – Other case-specific papers | 1-2 days |

| Register with DPI – Submit documents directly – Respond to any additional requests (if needed) | 2-3 days |

| Confirm & Transfer Capital – Receive capital contribution confirmation – Transfer funds via investment account – Finalize transfer | 1-2 days |

| Update ERC – Register ERC changes with the Business Registration Office at DPI | 1-2 days |

Note: You must apply for an Investment Registration Certificate in Vietnam if:

- Your contribution pushes foreign ownership from 50% or less to over 50%.

- You’re contributing to a company already over 50% foreign-owned.

If neither applies, an IRC isn’t required.

Notes After Successfully Obtaining IRC

1. Avoid Fines for Late IRC Renewal

Companies face fines of 70-100 million VND if their Investment Registration Certificate in Vietnam expires without renewal (per Article 17, Decree 122/2021/NĐ-CP). CMT’s Investment registration certificate application service offers automatic deadline reminders and fast renewal in 7-10 working days – keeping you penalty-free and compliant!

2. Replace a Lost or Damaged Investment Registration Certificate

You must reapply for your Investment Registration Certificate in Vietnam if it’s lost or damaged. Without a valid IRC, you risk heavy fines or even business suspension during surprise government checks.

When You Need a Replacement:

- Certificate is lost or damaged.

- Online National System data doesn’t match your IRC.

- IRC details don’t match your filed registration info.

Reapplying is as complex as the initial process, requiring detailed explanations and various supporting documents depending on the case. Doing it yourself could take 1-2 months, stalling your business. CMT’s urgent reissuance service gets it done in 5-7 working days, ensuring your Vietnam investment process stays on track!

Let Us Bring You Peace of Mind and Investment Success in Vietnam – Contact Us Now!

- Hotline: 094 344 342 (24/7 Support)

- Website: www.cmtconsulting.vn

- Email: cmtconsultingvn@gmail.com